A Fresh Look at Small Business Compliance: Cutting Through the Noise

Every day, small firms swim in a sea of transaction alerts. Most of these are harmless, but each “false positive” forces you to stop and investigate. Time drips away. Resources stretch thin. Your compliance team feels overwhelmed. You need clarity. You need precision.

Enter AI Visibility Tracking for small business compliance. This open-source platform shines a light on how AI systems interpret your transactions. It shows you when and why false positives pop up. It hands you straightforward insights—no code, no massive invoices, no spinning wheels. Boost your small business compliance with AI visibility insights is your first step toward smarter screening and tighter controls.

The False Positive Challenge in AML Monitoring

Banking and payments firms rely on anti-money laundering (AML) systems to spot suspicious behavior. These systems ask a simple question: “Could this transaction be risky?” When they lack nuance, they overreact. A customer moving money between two countries? Flagged. A routine purchase at a gas station near a known ringleader? Flagged. The result: floods of false positives.

Why does this matter for small businesses?

- Resource drain: Every flagged alert needs manual review.

- Customer friction: Delays frustrate buyers and suppliers.

- Regulatory risk: Missed genuine cases can lead to fines.

ComplyAdvantage’s platform, for instance, boasts an 82% reduction in false positives through AI-native detection and smart workflows. They merge behavioural insights with natural-language rules, giving large institutions sub-second processing and a clear audit trail. Impressive. But is it the right fit for a solo founder or a lean startup in Europe? Not always.

Why ComplyAdvantage Isn’t Enough for SMEs

ComplyAdvantage brings heavyweight compliance tools to the table. Their AI framework, bias management, and global reporting support are top-tier. Yet:

- Complex setup: Onboarding can take months.

- Costly licence: Pricing geared toward mid-to-large banks.

- Enterprise focus: Little attention to the realities of a three-person team.

Your small firm needs swift answers, not a six-figure implementation. You need transparent visibility into how AI speaks about you—how it compares you to competitors, how it explains its own reasoning, and where false positives hide. That’s where our open-source AI Visibility Tracking platform shines. Learn how AI visibility works

How AI Visibility Tracking Empowers Small Businesses

Imagine having a dashboard that shows you:

- Brand mentions in AI-generated search responses.

- Competitor analysis: see which rivals appear alongside your name.

- Narrative context: understand how AI describes your services or products.

- False positive hotspots: identify rule triggers that send harmless transactions to the bin.

You’ll spot patterns—e.g., your refund policy constantly triggers a velocity rule. You’ll tweak parameters in minutes using plain English instructions. No developers required. And because it’s open-source, you customise every rule without vendor lock-in.

Benefits at a glance:

- Built for non-tech teams.

- Transparent, natural-language audit logs.

- Community-driven enhancements.

- European-friendly data privacy.

Ready to see how it works in practice? Explore small business compliance with AI-powered insights

Key Benefits: From Noise to Clear Insights

Bullet lists. They work. Here’s what you gain:

- Affordable accuracy: Reduce false positives by up to 70%—without enterprise pricing.

- Instant adjustments: Change rule thresholds on the fly, test in a sandbox, then deploy.

- Explainable AI: Every decision comes with clear, human-readable reasoning.

- Scalable support: As you grow, the same platform adapts—no surprise overages.

- Community ecosystem: Get plug-ins, templates and rule packs from peers.

Plus, you still cover all your AML bases—reporting, case management, audit trails. You’ll never scramble to find a SAR or CTR template again.

Feeling curious about optimising your online reach while you tighten compliance? Explore practical GEO SEO strategies

Getting Started: Simple Steps to Smarter AML Monitoring

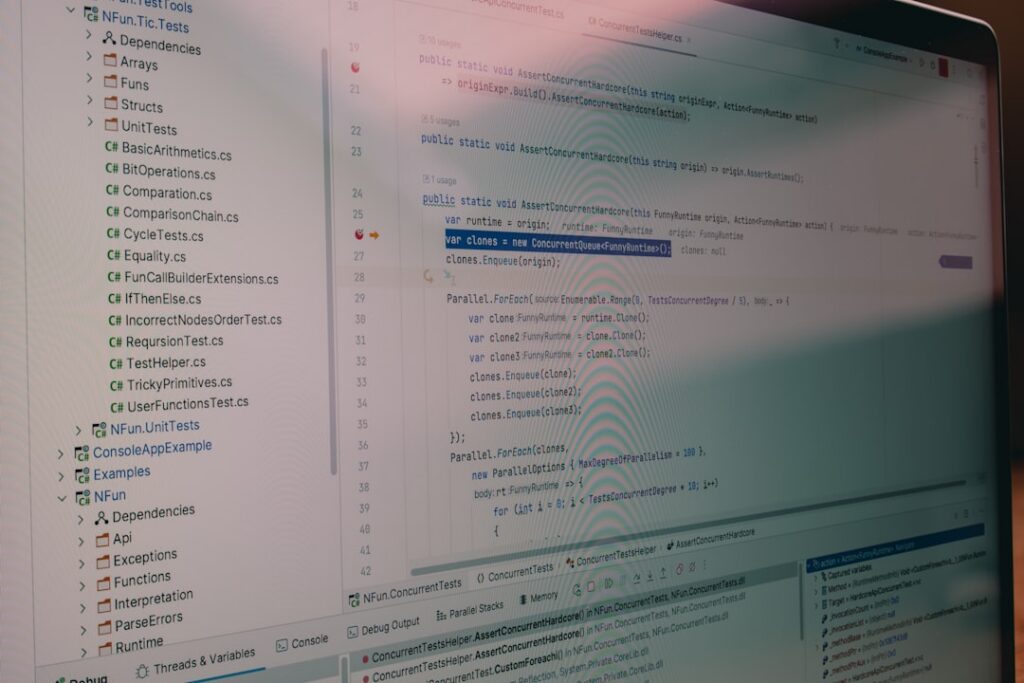

- Clone the repository: Our GitHub has everything you need.

- Initial setup: Follow the quick-start guide—no command-line voodoo.

- Define your rules: Write or import natural-language rules tailored to your risk profile.

- Connect your data: Plug in your transaction stream via REST API.

- Review and refine: Use the dashboard to spot false positives, tweak, test in sandbox.

Five steps. Less than an hour. And you avoid months of heavy lifting. While the big players wrestle with complex onboarding, you’ll be tracking, understanding, and resolving alerts in real time. Ready to automate both your SEO and compliance without lifting a finger? Run AI SEO and GEO on autopilot for your business

Testimonials

“Before this platform, we spent half our day on false positives. Now, we clear routine alerts automatically and focus only on real risks. It’s opened up more time for growth.”

— Emily Hart, Founder of EuroPay Solutions

“As a boutique payment provider, compliance can overwhelm us. The open-source AI Visibility Tracking cut our manual reviews by 60%. And I actually understand the audit logs!”

— Marco Rossi, Compliance Lead at MedInvoice EU

“I love that it’s transparent. I see why AI flags a refund or cross-border payment. No more guessing games. Perfect for a small team like ours.”

— Linda O’Connor, CEO of Fintech Pals

Conclusion: Your Next Step Toward Clear Compliance

False positives no longer need to derail your day. With AI Visibility Tracking tailored for small business compliance, you get clarity, control and community support—without the enterprise price tag or complexity. Ready to shift from firefighting alerts to proactive insights? Get started with small business compliance made simple